Payday Loans: Safe Borrowing Tips

Installation Loans Explained: Crucial Information for Consumers Seeking Financial Solutions

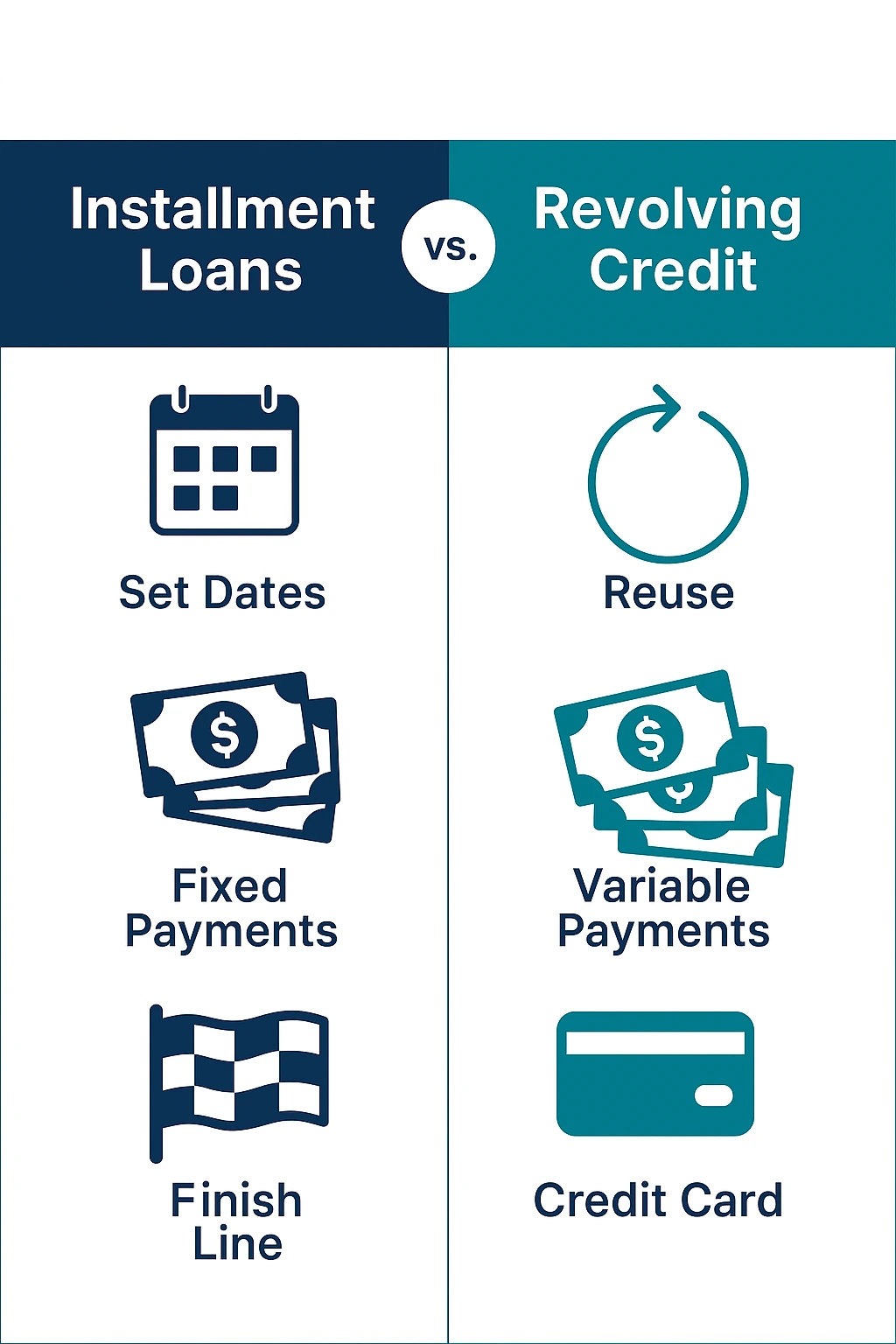

Installment lendings supply an organized approach to borrowing, providing debtors with a round figure that is repaid in dealt with installments gradually. These financings can be valuable for handling substantial costs, yet they likewise come with prospective risks. Understanding exactly how they work and the implications of taking one on is essential for anybody considering this monetary option. As consumers weigh their options, a number of elements require mindful factor to consider.

What Are Installment Loans?

Installation financings are a kind of borrowing plan where a consumer gets a swelling amount of cash and agrees to repay it in dealt with, set up payments over a given duration. These fundings are commonly used for various objectives, consisting of acquiring an automobile, moneying home improvements, or settling debt. Debtors typically gain from foreseeable settlement amounts, making it less complicated to spending plan.

The regards to installment lendings can vary greatly, including the rates of interest, settlement duration, and any kind of associated costs. Usually, these fundings are protected or unsecured, with secured lendings needing security to minimize lending institution danger. Installment finances can be accessed through typical banks, lending institution, or online loan providers, each providing different terms and requirements.

Because of their organized settlement strategy, installment finances can assist borrowers establish or boost their credit rating, offered they comply with the payment routine. Comprehending the fundamental aspects of installation car loans is vital for notified borrowing choices.

Exactly How Do Installment Loans Work?

Borrowers initiate the process of getting an installment loan by obtaining a particular quantity of money, which is then examined by the loan provider based on credit reliability and economic history. As soon as accepted, the loan provider pays out the finance total up to the borrower, who agrees to a settlement schedule. This routine usually requires set regular monthly settlements over a fixed period, which can range from numerous months to numerous years.

The settlements are composed of both major and passion, allowing consumers to gradually lower their debt. Rate of interest might differ relying on aspects such as credit history and loan term. Customers need to stick to the payment strategy, as missing repayments can bring about charges and negatively affect their credit rating. Furthermore, loan providers may call for security for larger lendings, supplying safety against potential defaults. In general, comprehending the mechanics of installation lendings is necessary for debtors seeking economic remedies.

Benefits of Securing an Installment Funding

Taking out an installment car loan uses numerous advantages that can be advantageous for those looking for monetary support. One crucial benefit is the predictable settlement structure, which enables debtors to intend their budgets successfully. Unlike rotating credit rating, installation lendings have actually taken care of regular monthly repayments, making it simpler to take care of funds. In addition, these fundings typically come with lower rates of interest contrasted to charge card, which can result in substantial financial savings with time.

Another benefit is the potential to boost credit history. Timely repayments on installation finances can boost a borrower's debt profile, opening up doors to far better monetary opportunities in the future. Installation lendings can supply access to bigger amounts of money, allowing individuals to deal with significant expenses.

Lastly, the application process for installment finances is typically straightforward, frequently requiring minimal documents, which can bring about quicker authorization and funding. Cash Loans. These aspects make installment car loans a feasible alternative for lots of consumers looking for monetary services

Common Uses for Installation Loans

Installation loans offer different sensible objectives for borrowers. Usual applications consist of funding home renovations and helping with financial debt loan consolidation. These loans offer an organized settlement strategy, making them appealing for taking care of considerable expenditures.

Home Improvements Financing

When home owners make a decision to enhance their home, financing alternatives like installation car loans usually become a feasible remedy. These financings offer an organized method to money different home renovation tasks, such as kitchen area remodels, restroom upgrades, or energy-efficient installations. By offering fixed monthly payments and details repayment terms, installment loans make it possible for house owners to budget plan successfully and handle their financial resources without substantial strain. Additionally, these fundings can cover both small remodellings and larger construction tasks, catering to a variety of needs. Home owners can leverage the equity in their properties or decide for unsafe finances, relying on their monetary situation. On the whole, installment lendings function as a functional source for people seeking to buy their homes and enhance their high quality of life.

Financial Obligation Combination Assistance

Home owners commonly deal with address different economic challenges, and one common issue is managing several financial obligations. For numerous, financial obligation consolidation making use of installment finances presents a reliable remedy. This strategy enables customers to combine numerous high-interest financial obligations into a single, manageable repayment with a set rate of interest and term. By settling debts, property owners can enhance their financial resources, lower regular monthly settlements, and possibly lower their overall passion costs. In addition, installation car loans typically supply foreseeable repayment routines, making budgeting less complicated. This financial technique not just alleviates tension however likewise assists improve credit rating by lowering credit history use proportions. Generally, debt consolidation assistance with installation loans can provide property owners with a more clear course to economic stability and tranquility of mind.

Potential Downsides of Installment Loans

While installment lendings can be helpful, they also include a couple of noteworthy disadvantages. High rates of interest might cause enhanced total prices, and the taken care of payment schedule can produce economic stress. In addition, there is a risk of overborrowing, which can exacerbate debt issues for consumers.

High Rate Of Interest

Installment car loans can supply quick accessibility to funds, they typically come with high rate of interest prices that can substantially enhance the complete cost of loaning. Consumers may discover themselves paying significantly even more than the major quantity over the period of the car loan. These high prices can be credited to different factors, including the borrower's credit reliability, the funding quantity, and the loan provider's plans. While some debtors might focus on instant economic requirements, they should carefully analyze the long-lasting effects of higher interest settlements. An enhanced economic burden might cause troubles in managing future expenses. It is crucial for potential debtors to completely evaluate the interest prices connected with installment finances before making a decision.

Risk of Overborrowing

High rates of interest can lead consumers to tackle more financial obligation than they can manage, leading to the risk of overborrowing. This phenomenon happens when people, inspired by immediate economic requirements, secure bigger finance quantities than needed, usually without fully considering their payment ability. Therefore, they might discover themselves caught in a cycle of financial debt, struggling to fulfill regular monthly obligations while building up additional passion. Overborrowing can additionally result in reduced credit history, making future borrowing much more tough and pricey. In addition, customers might experience elevated anxiety and anxiousness, influencing their general economic well-being. As you could try these out a result, it is crucial for consumers to assess their economic situations meticulously and stay clear of the temptation to handle too much financial obligation, guaranteeing they remain within their means.

Repaired Repayment Arrange

A set settlement routine is a defining quality of installation lendings, providing borrowers an organized framework for payment. While this predictability can be advantageous, it likewise offers possible disadvantages. Borrowers are commonly locked right into an inflexible layaway plan, which might not suit unforeseen financial changes, like task loss or medical emergency situations. This strength can bring about battles in conference payment responsibilities, possibly causing late costs or damage to credit report. Additionally, customers may discover themselves paying extra in passion if they wish to pay off the funding early, as several loan providers enforce early repayment fines. While a fixed repayment timetable can provide clearness, it might also limit monetary flexibility and versatility for consumers facing unanticipated conditions.

Tips for Choosing the Right Installment Loan

Regularly Asked Inquiries

What Credit Rating Is Required for an Installment Loan?

A credit history of 580 or higher is generally required for an installation lending. Nonetheless, some lenders may provide options for those with lower scores, usually leading to higher rates of interest and much less beneficial terms.

Can I Repay My Installment Car Loan Early?

Yes, debtors can usually pay off their installment lendings early. They ought to evaluate their funding arrangement for any kind of early repayment penalties or fees that might use, as these can influence the overall financial savings from early repayment.

Exist Fees Related To Installation Loans?

Yes, there can be costs linked with installment financings, including source costs, late payment charges, and early repayment charges. Customers ought to completely review car loan arrangements to recognize all potential costs prior to devoting to a loan.

How much time Does It Require To Get Authorized?

Authorization for installment financings usually takes anywhere from a few mins to numerous days, depending on the loan provider's policies and the efficiency of the candidate's documents. Quick on the internet applications typically expedite the process considerably.

Will Taking an Installation Lending Influence My Credit Rating?

Taking an installation lending can affect a credit report both favorably and negatively (Installment Loans). Prompt settlements might improve credit reliability, while missed out on payments can bring about a decline, mirroring the significance of responsible borrowing and settlement habits

Installment fundings use an organized approach to borrowing, supplying customers with a lump amount that is repaid in taken care of installations over time. Typically, these fundings are protected or unsafe, with secured fundings needing collateral to minimize lender threat. Due to their organized settlement plan, installment loans can assist borrowers establish or boost their credit rating, given they adhere to the repayment schedule. Debtors launch the procedure of obtaining an installment loan by using for a certain amount of cash, which is then evaluated by the lending institution based on creditworthiness and financial background. Prompt settlements on installation financings can improve a consumer's credit rating profile, opening up doors to far better monetary chances in the future.